Financial

wellbeing for all

MoneyFit delivers financial education and engaging tools to maximise employee financial wellbeing

“Financial wellbeing is about feeling in control of your money and being hopeful about your financial future”

The National Forum for Health and Wellbeing at Work

37%

Of UK employees cite financial pressure as their leading cause of stress outside work.

ONLY

10%

of employees state that their employer has asked them if they would like support with their financial wellbeing.

50%

of employees don't fully understand their benefits offering.

3 Pillars of

Financial Wellbeing

Confidence

to make financial decisions

Control

over budgeting and debt

Capacity

to save for the future

Key Features

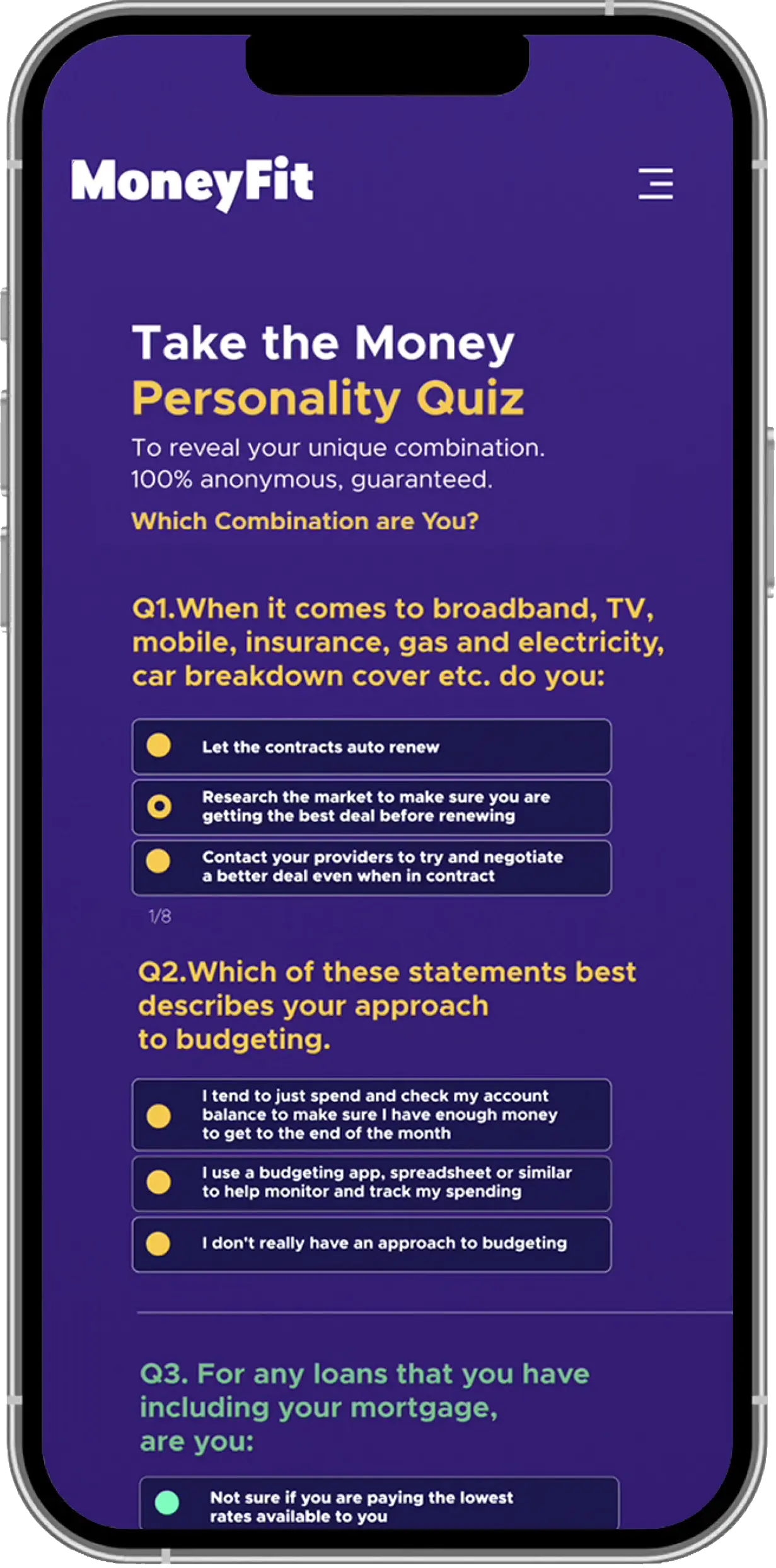

The MoneyFit Quiz

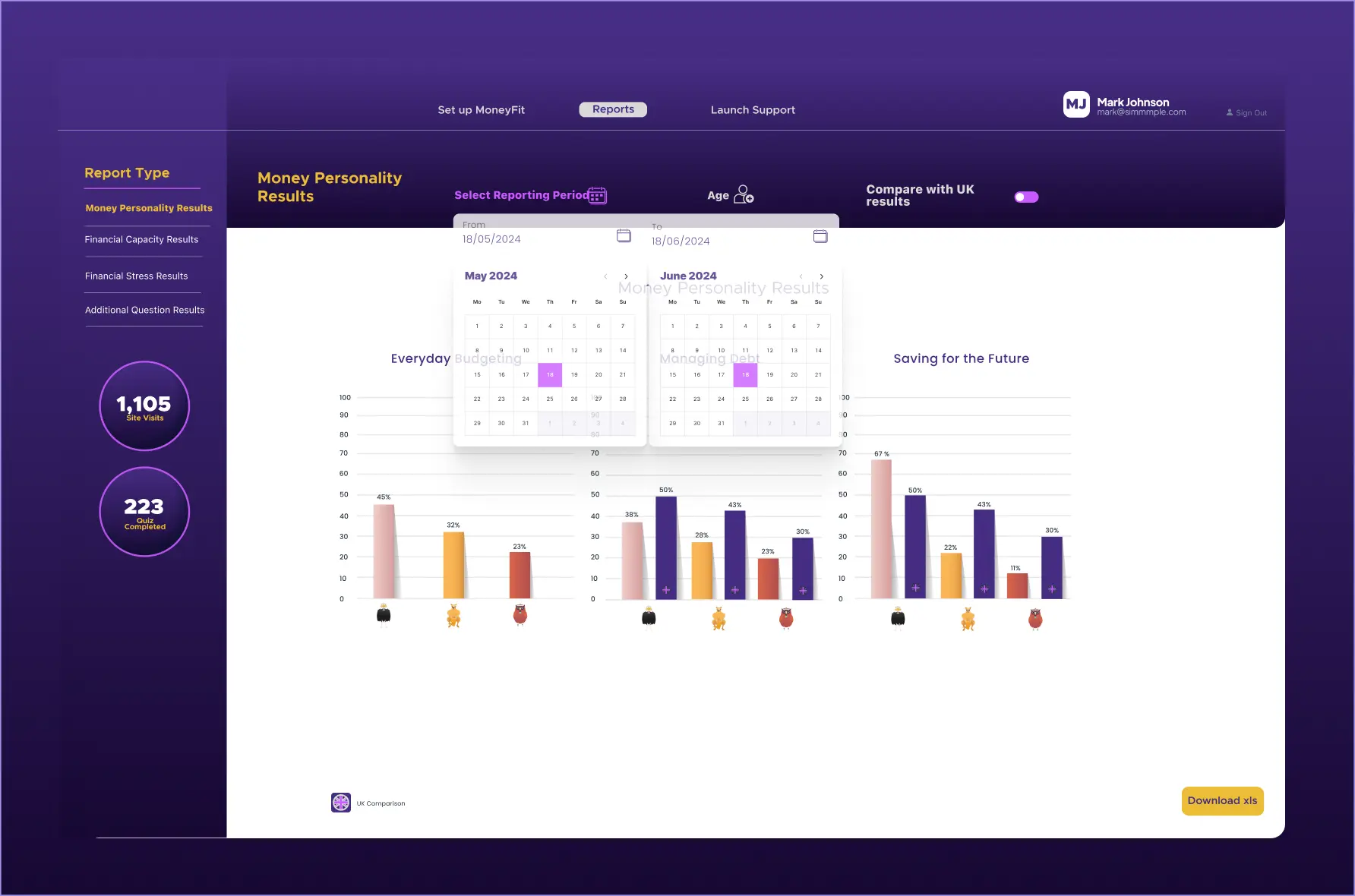

The MoneyFit quiz assesses individual attitudes to money and financial wellbeing. 100% anonymous, the quiz delivers a unique money personality combination using engaging animal personas and a bespoke action plan to improve money fitness, plus comparison against UK results.

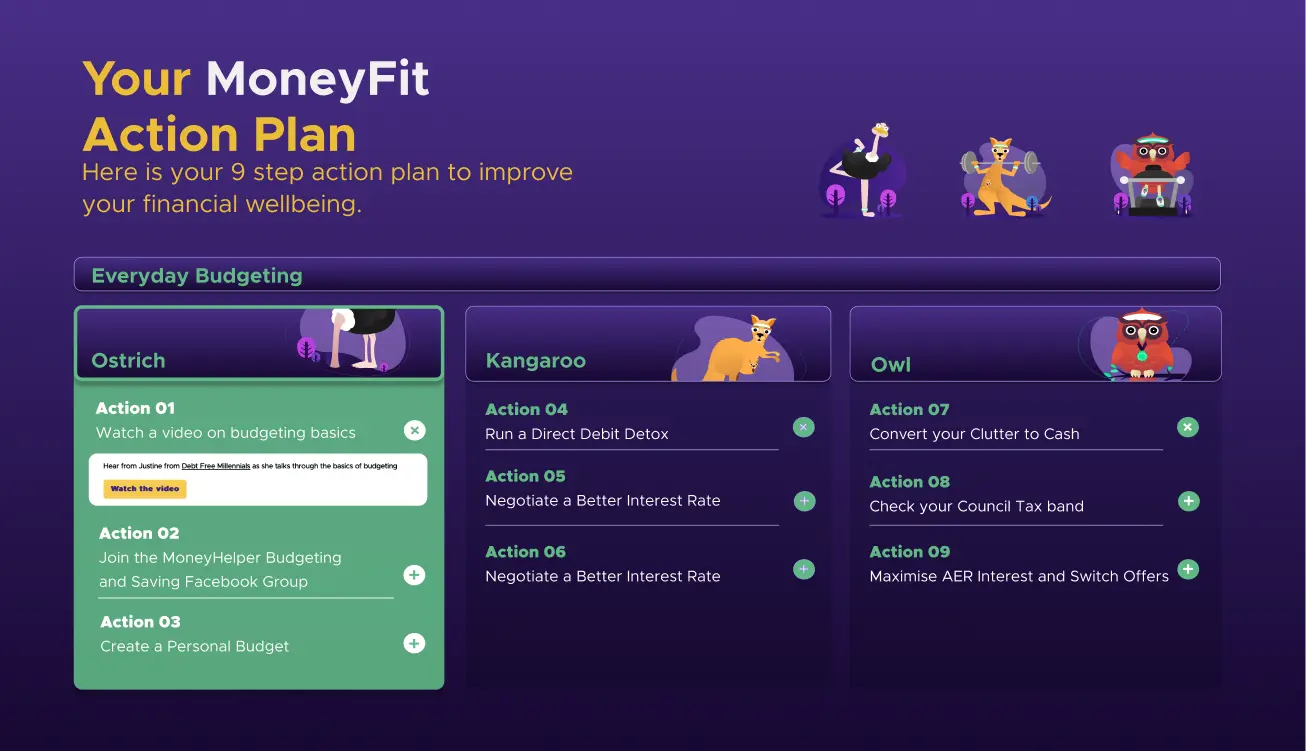

Bespoke

Action Plan

The bespoke action plan recommends priority actions that will help improve financial confidence, control and capacity. Based on the outputs of the MoneyFit quiz, users can complete their action plan at their own pace and build their money fitness over time.

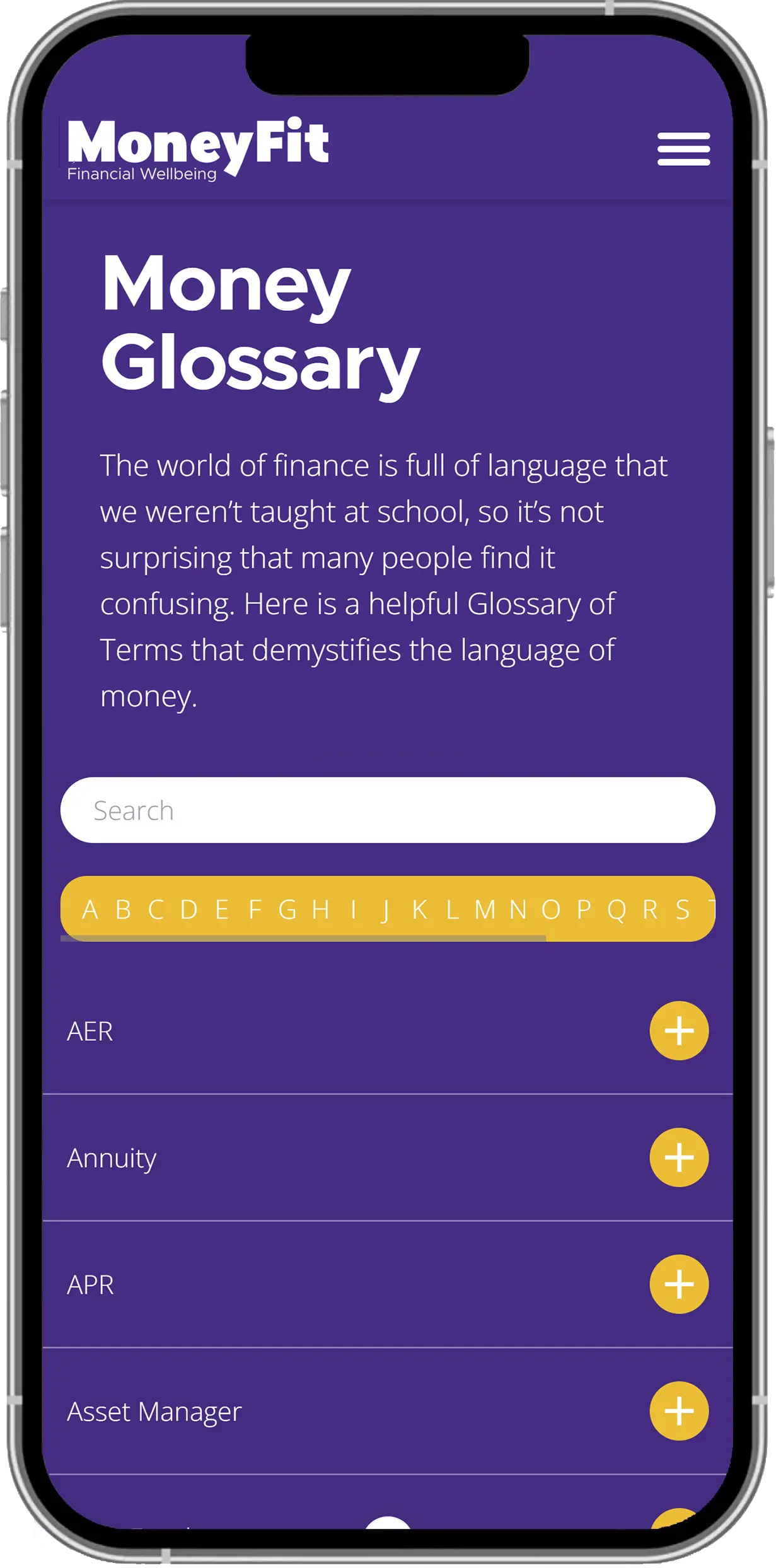

Financial

Education

Engaging financial education content that explains complex finance topics in plain English. The Money Glossary includes links to carefully selected resources on topics such as everyday budgeting, managing debt and saving for the future. MoneyFit Classes are a series of on-demand explainer videos that explain topics including the maths of money, student loans, mortgages and savings with clear illustrations and practical examples.

Finance Focus Areas

Engaging Tools

Cashback card

The plastic-free digital cashback card delivers cashback of up to 14.5% at over 80 UK retailers. Easily accessible via Apple Pay and Google Pay, the MoneyFit Cashback card makes everyday budgeting and spending more rewarding. Learn more

Earn up to 14.5% cashback at over 80 popular retailers

Employee Benefits Communication

Ensure that employees never miss out on the money-saving benefits available to them. The employee benefits content editing tool enables employers to communicate all their benefits in one place including links to the intranet and company benefits platform.

Money Modellers

Engaging interactive modelling tools that illustrate the impact of everyday budgeting decisions and interest on loans and savings. Includes the small savings add up modeller that highlights the cumulative impact of micro spending over time.

Help and Support

Practical help and support with links to resources on topics including money and mental health and gambling addiction.

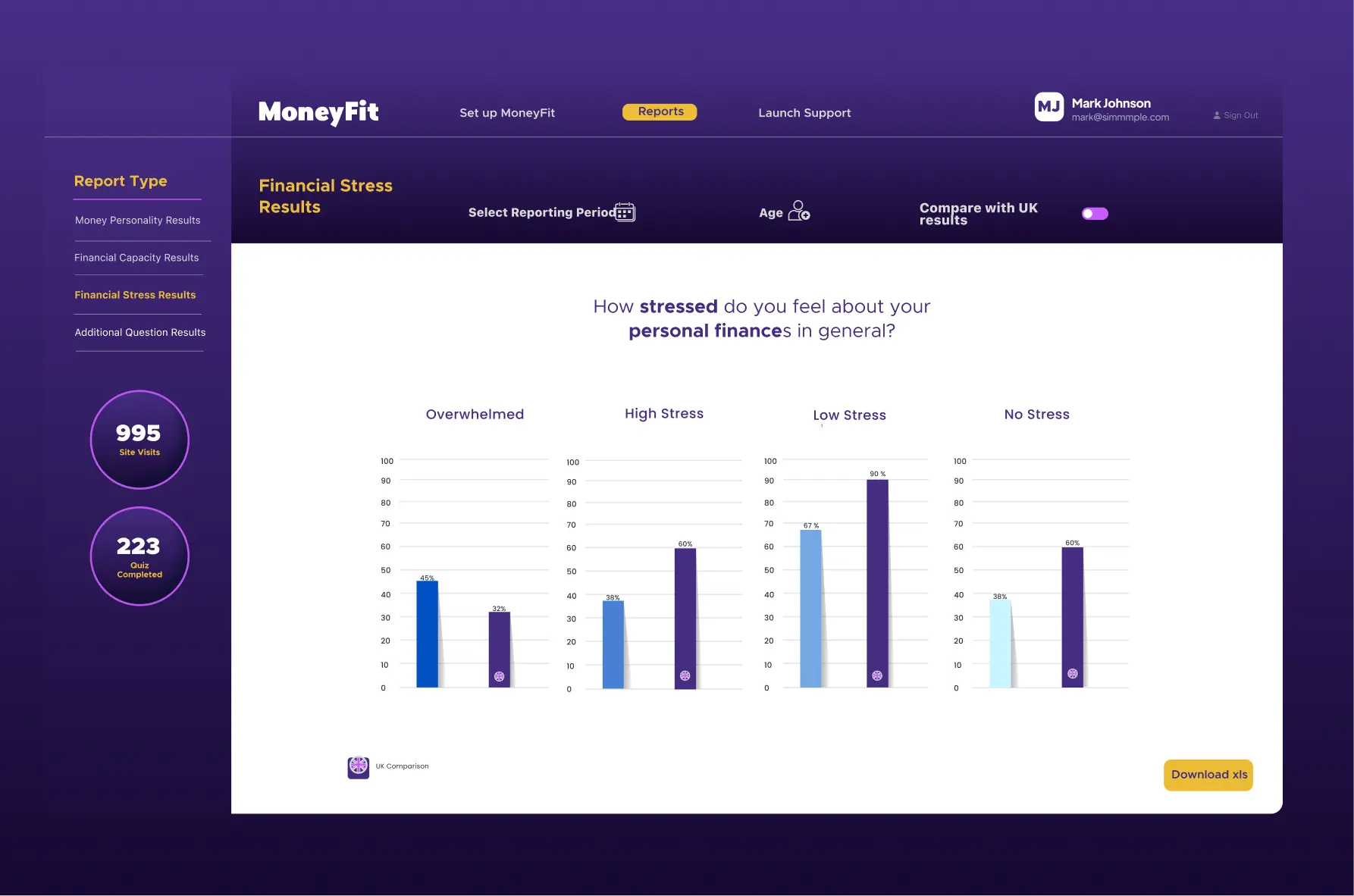

Data and Insights

The interactive employer dashboard provides real-time insights into employee financial wellbeing including comparison with UK data. Additional quiz questions can be added to provide further employee data on topics such as employee benefits understanding.

Financial Capacity

Could your household afford to pay an unexpected, but necessary expense of £850?

Financial Worry

How stressed do you feel about your personal finances in general?

Rapid Implementation

MoneyFit is a hosted software as a service (SAAS) platform enabling rapid implementation with zero impact on existing HR technology infrastructure. Includes a fully customisable content editing tool and built-in communication assets for fast effective deployment.

Industry

Awards

Best Health and Wellbeing Solution, Corporate Adviser Awards 2022

Winning Solution MoneyFit

Winning Provider Gallagher

Best Financial Wellbeing Solution, Employe Benefits Awards 2022

Winning Solution MoneyFit

Winning Employer Claranet