Managing Debt

Credit cards, mortgages, finance and loans

Whether it’s a credit card, bank loan or car loan, the vast majority of loans will cost the borrower in interest payments.

On some occasions, it's possible to get an interest-free loan (e.g. when buying a new sofa), but even ‘0% balance transfer credit cards’ charge a fee as a percentage of the value of the balance being transferred. Loans aren’t necessarily a bad thing, but very high interest loans aren’t a good thing. For most people, it would be impossible to buy a flat or a house without a mortgage loan. If the repayments are affordable, a loan is a great way to buy goods and services and pay back over time.

Here are some useful resources on credit cards, loans and finance.

A mortgage is a loan that is secured on a property such as a flat or a house. A mortgage is invariably the largest and longest term loan that a person or couple will have in their lives. Paying off a mortgage is a huge milestone that often takes 25+ years to achieve. It’s important to understand how mortgages work and how to get the best value deals available. A 1% increase in mortgage interest over the lifetime of a mortgage can mean £1000’s more in interest payments, so it’s worth getting the best possible mortgage deal available.

Interesting Fact: The total value of all mortgage loans in the UK is over £1.63 trillion. In numerical terms that’s over £1,630,000,000,000,000,000

Here are some useful resources on mortgages:

Student loans are available for most (not all) graduate and post-graduate courses, and can include a Tuition Fee Loan to pay for the tuition, and a Maintenance Loan to help with living costs. Tuition Fee Loans cover the full cost of the course and are paid directly to the course provider. Maintenance Loans can be applied for at the same time, and the amount available depends on a variety of factors, including household income and location of study.

Loan repayments start from the April after the course is finished, and are collected through the UK tax system if employed, or through Self Assessment if self-employed.

Repayments only start when income is over the repayment threshold, which is currently £27,295 a year, £2,274 a month or £524 a week in the UK.

Repayments are calculated as 9% of all income over the repayment threshold, so an individual earning £33,000 per year will pay 9% per year on £5,705 - which is equivalent to £42 per month.

To learn more about student loans, visit:

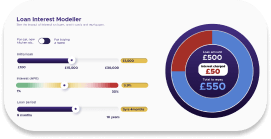

Visit the Loan Interest Modeller to see the impact of interest on loans.

Resource Zone

Money can be a daunting topic with unfamiliar language and terminology. Here in the Resource Zone you can learn about the topics that matter to you, bookmark pages and links and learn at your own pace.